Self-Managed Super Funds: The ATO's perspective, latest superannuation update and the current environment for financially stressed businesses

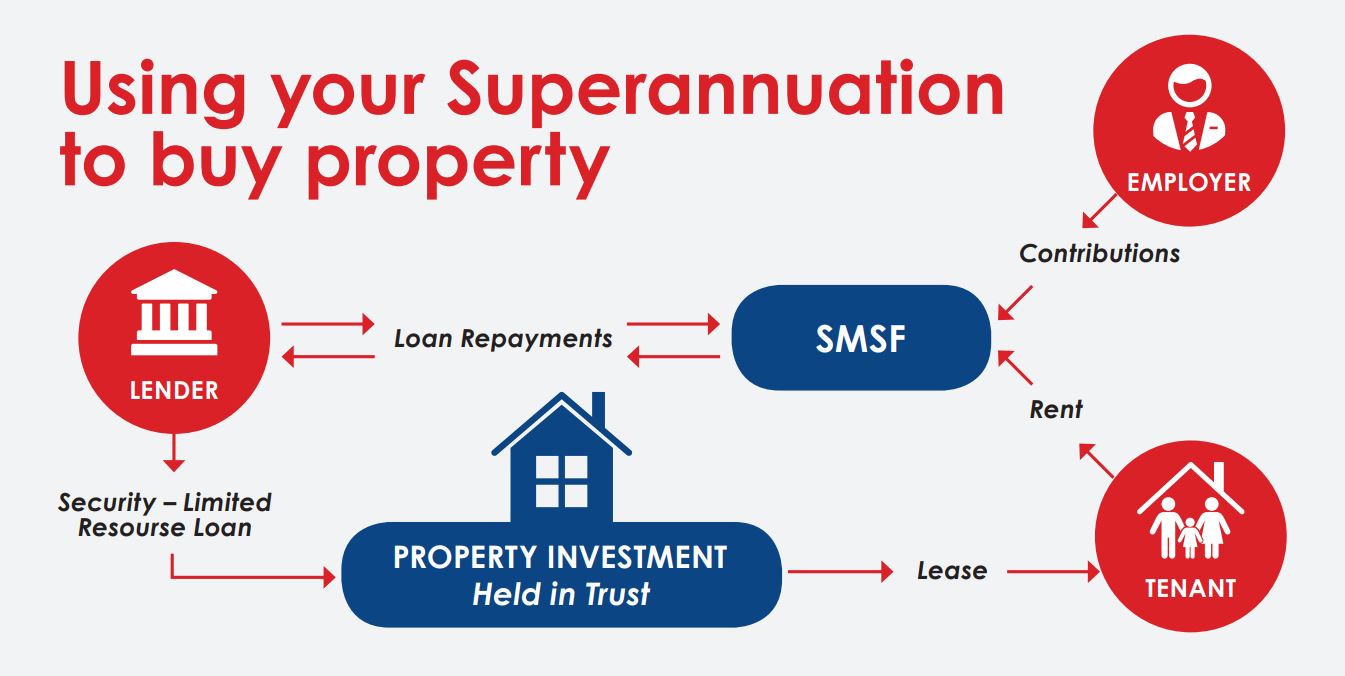

Optimisers KPO Private Limited - Self-managed super funds(SMSFs), also known as do-it-yourself superannuation schemes, are designed for the individual to have direct control over their retirement saving. We can take care of